Potato retail volume is up as cost-of-living pressure has led to less food being purchased out of home and more through retail. The fresh potato retail market for MAT to March 2024 was 365,074 tons, up 7.90% compared to last year, and generated over $1M, an increase of 8.63% from last year.

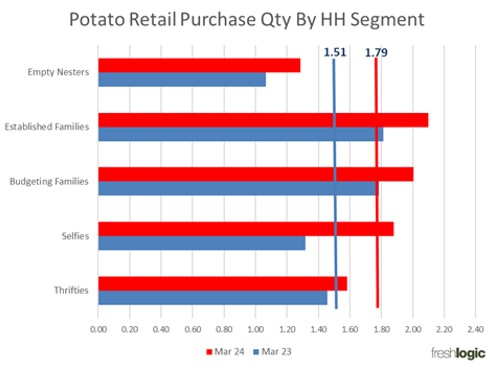

The quantity of potatoes purchased per shopping trip has increased by 18% (March 2023 vs. March 2024), reflecting a willingness of households to buy more, knowing the potatoes will be used. Household food shopping patterns, averaging 2.5-3 trips per week, have slightly increased as more food shoppers are visiting multiple supermarkets to find the best value.

However, there are two contrasting patterns regarding the increased quantity per trip:

- The sales mix contribution of smaller 1 kg packs has increased.

- The sales mix of loose self-select potatoes has increased their share of category sales, with 70% of these purchases being less than 1 kg.

It is concluded that larger family households are buying more, which has raised the average trip quantity. Nevertheless, there is still strong demand for smaller portions.

Awareness and sensitivity to home waste have been heightened by increased consumer advocacy and technological aids, which raise awareness and inform about the household cost of home waste. As a result, waste-sensitive households tend to purchase smaller quantities. Not surprising when 22% of Australian households are single-person.

Want to learn more about your fruit or vegetable category? Contact Us today for a demonstration of our services and to help us understand your needs.

Stay ahead of the latest trends and insights in the fruit and vegetable supply chain—subscribe to our weekly newsletter today.