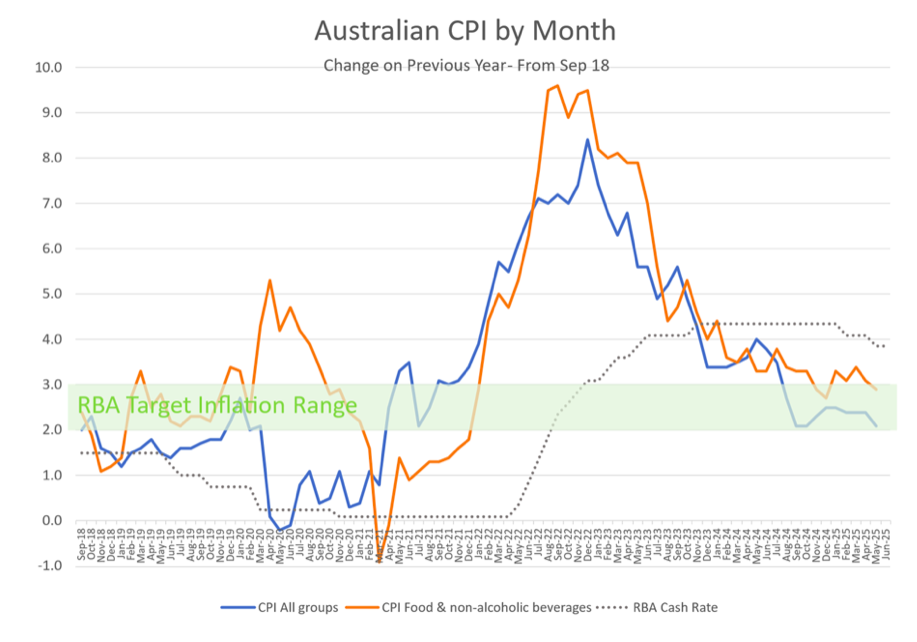

The latest data highlights a softening in inflation, alongside a slight decline in RBA cash rates, which will have flow-on effects across the horticulture and retail food sectors.

For the quarter, food and non-alcoholic beverages increased by 3.0%, compared with All CPI at +2.3%. Both measures have eased compared to the previous quarter, pointing to a broader cooling of inflationary pressures.

The RBA reduced its cash rate from 4.10% to 3.85% in May, though it continues to sit well above both All CPI and Food & Beverage CPI. Importantly, All CPI is now positioned within the RBA’s target inflation range, suggesting monetary policy settings are beginning to align more closely with economic conditions.

While these trends signal some relief, the cost of living continues to weigh heavily on households. This has enabled the retail food sector to capture a greater share of market volume, as consumers prioritise grocery spending over discretionary categories.

The timing and patterns of these shifts are captured in the chart, which tracks CPI for All Groups, CPI for Food & Non-Alcoholic Beverages, and the RBA cash rate.

For the horticulture industry, these dynamics underscore the importance of monitoring both consumer behaviour and retail market positioning. A softer inflation environment may offer opportunities, but household budget pressures mean value-driven purchasing will continue to shape demand.

What this means for horticulture

While inflation and interest rates are beginning to ease, household cost-of-living pressures remain a strong force shaping consumer behaviour. For the horticulture industry, this means retail demand will continue to prioritise value and affordability, impacting product mix, pricing strategies, and category performance.

👉 Freshlogic’s Category Analysis service tracks these market dynamics across the supply chain, combining consumer demand and supply insights through our THRUChain™ system. This enables producers, retailers, and investors to understand how shifts in CPI, household spending, and retail strategies flow through to fresh produce sales and margins.

Contact us today for our Category Analysis brochure.

If you’d like to discuss how Freshlogic may be able to help your business, Contact us today or book in a demonstration of our services.

If you’d like the freshest fruit, vegetable and horticulture industry news, join our weekly newsletter!