The latest Mealpulse™ data reveals that Australian shoppers continue to split their grocery spend across multiple supermarkets, but Coles and Woolworths are successfully increasing the amount spent during their shoppers’ main, first-store visit – a key shift in supermarket trends.

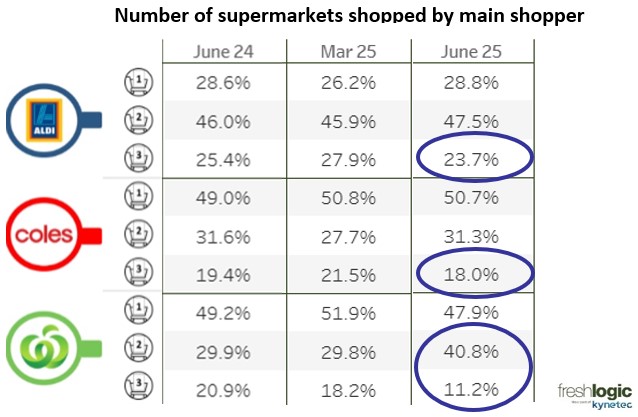

When shoppers were asked to nominate their main supermarket, the June 2025 quarter results show:

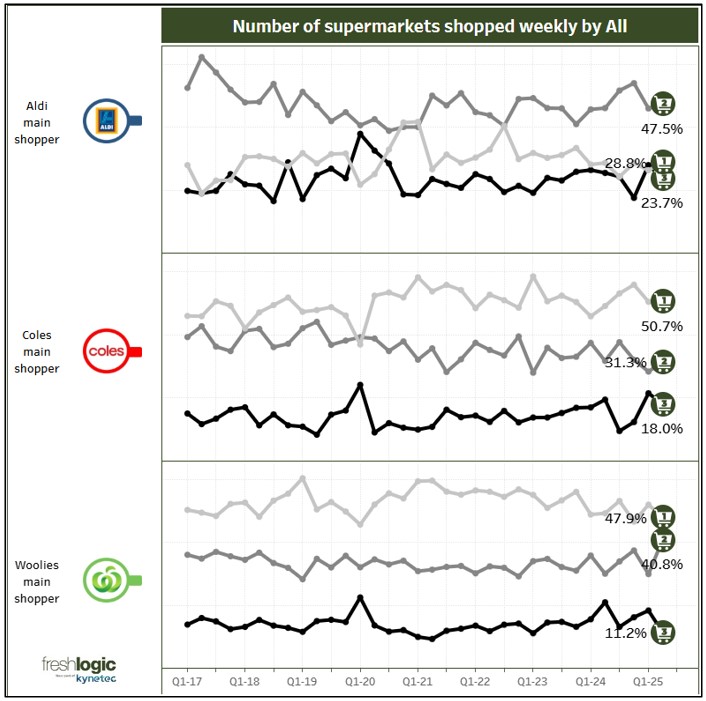

- Aldi has maintained its single-store shopper proportion at around 29%, with two-store shop behaviour rising slightly to 47.5%.

- Coles single-store shopper loyalty remained stable at 50.7%, while three-store shop behaviour eased slightly from last year’s peak to 18.0%.

- Woolworths saw the biggest shift, with one-store shop behaviour declining to 47.9% and two-store shop behaviour jumping to 40.8%, while three-store shop behaviour dropped sharply to 11.2%.

Across all three retailers, there’s been a decline in three-store shop behaviour and a lift in two-store shop behaviour. This means shoppers are still visiting more than one supermarket, but fewer are visiting three.

Importantly, while participation in cross-shopping remains high, Coles and Woolworths are growing their share of wallet among these cross-store shoppers by driving larger basket sizes during the first, main shop (first-store shop). This suggests that promotional activity and in-store tactics are successfully encouraging shoppers to spend more upfront, even if they later visit other retailers.

These behavioural shifts highlight the evolving balance between shopper loyalty and competitive spend capture, suggesting that the battle for the first, main-shop dollar is intensifying.

Turn cross-shopping, supermarket trends into actionable insights

The June 2025 supermarket cross-shopping trends are just one example of the depth available through Freshlogic’s Food Consumer Insights service.

Our Retailer & Shopping Pattern Analysis tracks how shopping trips are distributed among major retailers, measures loyalty, and reveals the total trip frequency.

With over 15,000 weeks of household food shopping data and 800,000 product purchase records, you can:

- Pinpoint loyalty drivers and identify opportunities to win back at-risk shoppers.

- Understand basket dynamics – from trip spend and basket size to companion products.

- Track online grocery performance and measure market share shifts.

- Leverage 12+ years of historical trends to anticipate consumer behaviour changes.

- Profile split shopping patterns to target promotions and retain more first-shop dollars.

Move beyond headline stats, uncover the motivations, spending habits, and patterns that shape Australia’s food retail market.

Explore Food Consumer Insights →

If you’d like to discuss how Freshlogic may be able to help your business, Contact us today or book in a demonstration of our services.

If you’d like the freshest fruit, vegetable and horticulture industry news, join our weekly newsletter!