We’ve come to understand that the typical Australian consumer doesn’t confine their grocery shopping to just one store anymore. In fact, it’s become increasingly common for individuals to visit two or even three different grocery stores each week to fulfill their needs. This trend, known as Cross Shopping, reflects a shifting dynamic in consumer behaviour.

As part of our December Quarterly Fruit and Vegetable Market Insights report, we’ve conducted an in-depth analysis of Cross Shopping supermarket patterns in the December 23 and December 24 quarters.

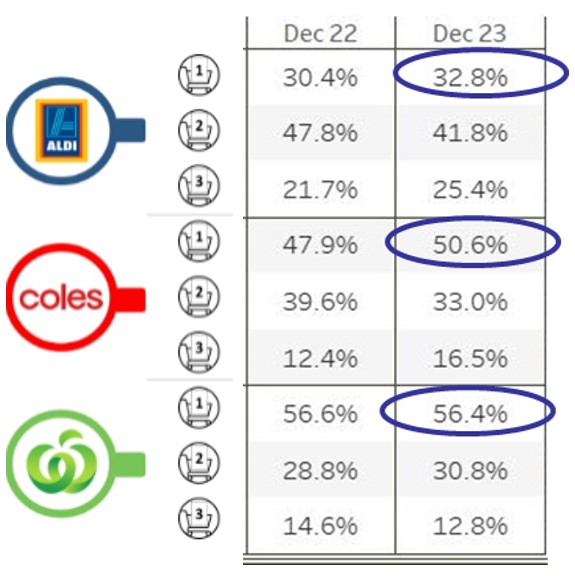

Our analysis, as detailed in the below table, sheds light on the intricate differences in shopping behaviours during these periods. We’ve profiled shopping trips based on shoppers’ nominated main supermarkets, aiming to unveil loyalty levels and the frequency of shopping trips.

Here’s a glimpse into some key insights:

- Continued growth in retail food demand: The pattern of food service channel growth easing and households required more meal ingredients from retail food continued. This indicates a shift in consumer behaviour towards purchasing meal ingredients from retail food providers.

- Loyalty and trip spend: Aldi and Coles witnessed a surge in shoppers undertaking their first shop in their stores, indicating higher loyalty and trip spend from these customers. However, both retailers are trailing behind Woolworths on this measure.

- Cross Shopping patterns: Cross Shopping patterns revealed Aldi & Coles had decreases in second shop and similar increases in the third shop, which is expected to be driven by shoppers looking for value across all retailers. Simultaneously, increased promotional activity amongst retailers (monitored by Freshlogic’s Promotional Activity platform, Adwatch) captures shoppers looking across multiple supermarkets to gain the best deal.

As we navigate the ever-changing retail landscape, understanding these patterns can provide valuable insights into consumer preferences and behaviours. Whether you’re a retailer seeking to enhance customer loyalty or a distributor looking to target specific consumer segments, our analysis can guide your 2024 planning. If you’d like to learn more about Cross Shopping or understand your fruit and/or vegetable category further, please contact us.

Stay ahead of the latest trends and insights in the fruit and vegetable supply chain—subscribe to our weekly newsletter today.